Learn About the Budget

Budget Overview

-

The Community College of Rhode Island prepares and submits its annual budget request to the Rhode Island Office of Postsecondary Council (OPC) for review and consolidation with the budgets of URI, RIC and OPC itself. The comprehensive budget for Higher Education is formally adopted by the Post Secondary Council for Higher Education and ultimately the Council on Postsecondary Education.

-

The budget formulation process begins with parameters as defined by the RI State Budget Office as well as OPC. OPC guidelines are especially pertinent to any changes in Tuition and Fees.

-

The formulation of the college's budget is the responsibility of the Business Manager, who reports to the Vice President for Business and Strategy. The Business Manager is responsible for the oversight and planning to ensure that the college expenditures are consistent with forecasted revenues while aligning with the college's strategic plans.

Budget Basis

-

The college follows the State of Rhode Island’s fiscal year which runs from July 1st through June 30th.

-

CCRI is required to submit a balanced budget in which estimated revenues equal or exceed estimated expenditures.

-

The college’s operating budget uses modified accrual basis of accounting which states that revenues are recognized in the accounting period they become available and measurable. Expenditures are recognized in the accounting period that the fund liability was incurred. Purchase Orders and other commitments use encumbrance accounting in order to record the reserve of funds in the proper fiscal year.

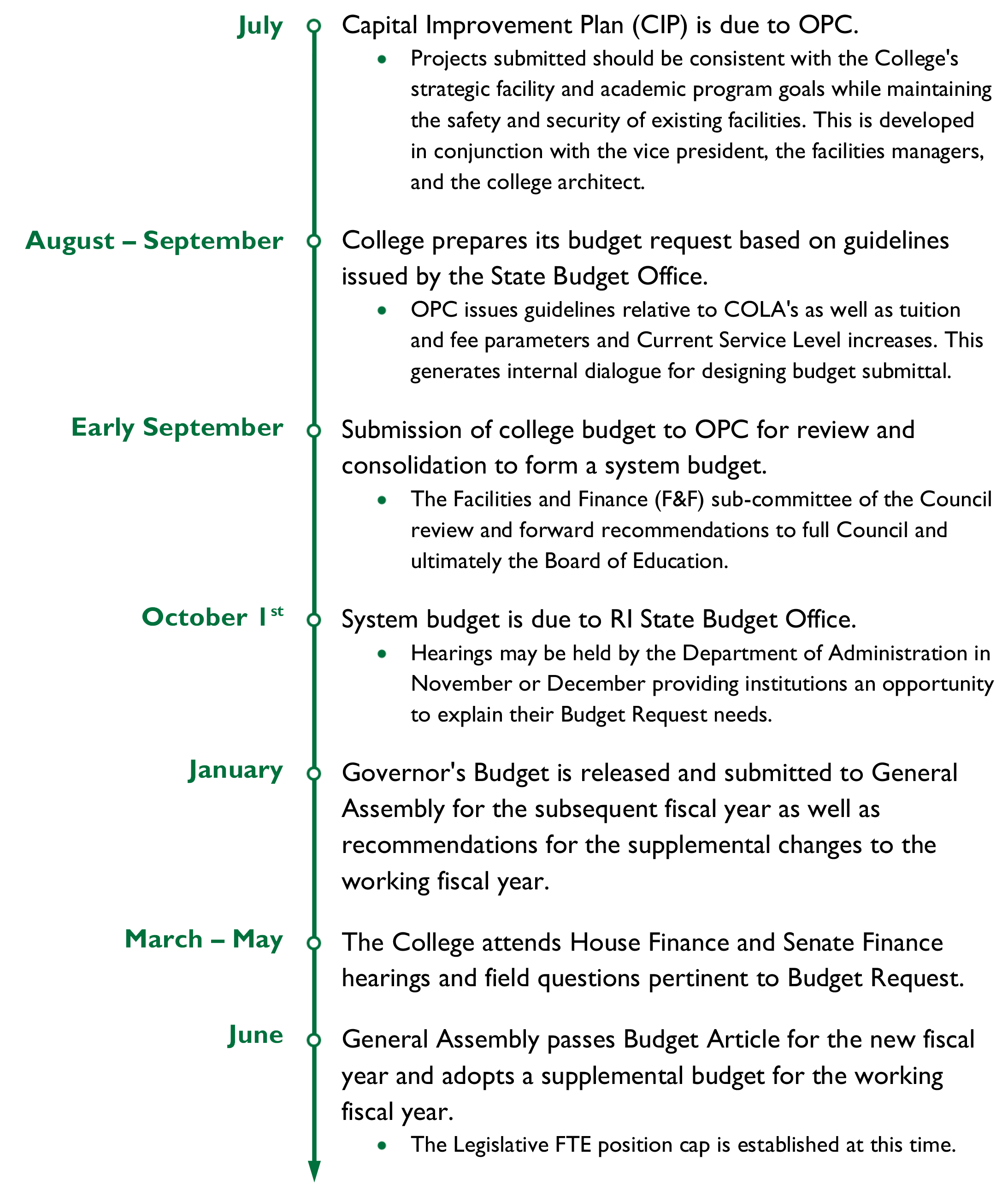

Timeline

Revenue Sources

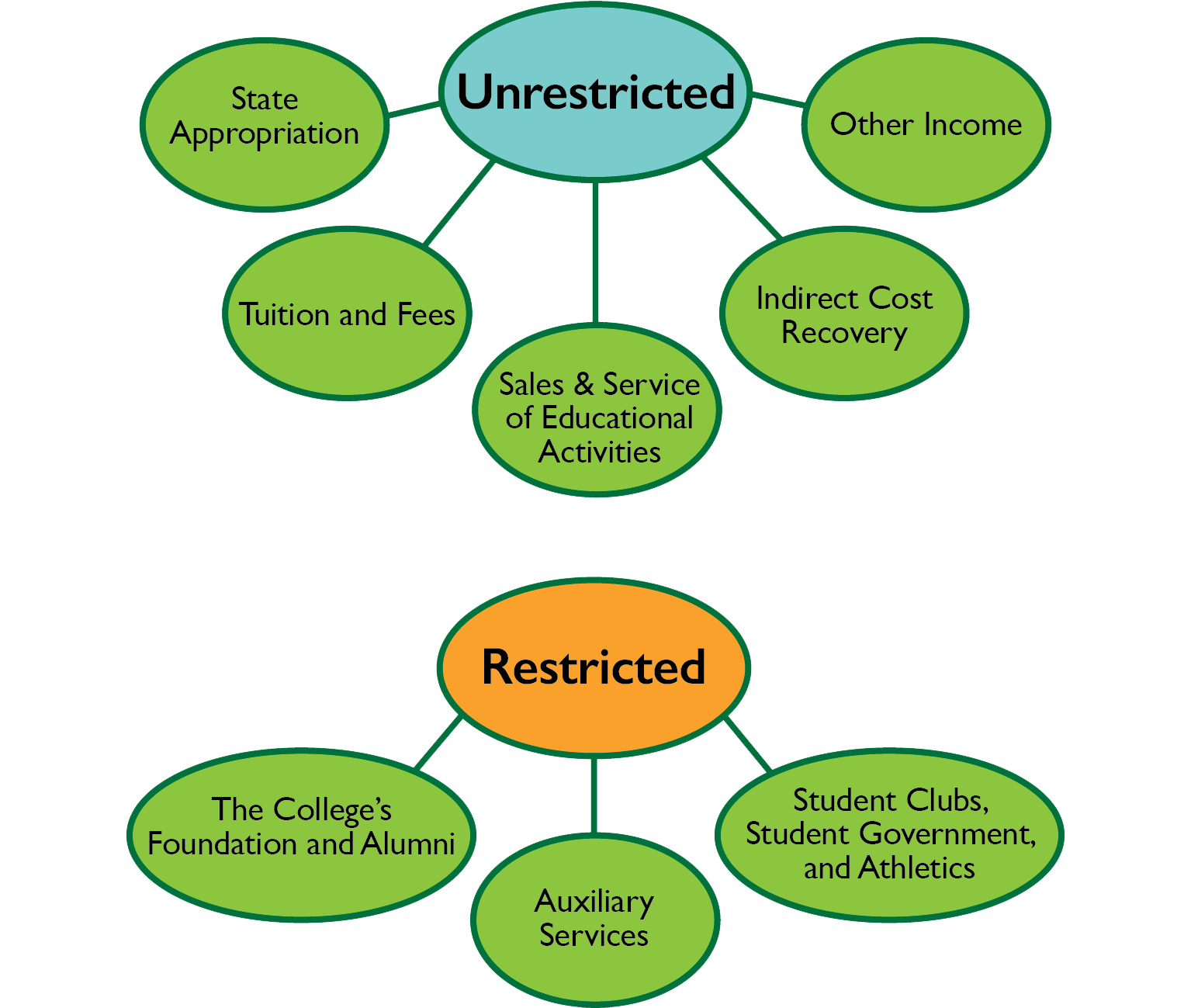

UNRESTRICTED REVENUES - Funding that support the General Revenue budget of the college. These funds are unrestricted in the sense that the college has a reasonable level of autonomy on how they may be used to support the college's mission and goals; however, expenditures must be legal and ethical within State of Rhode Island and Council on Postsecondary Education's policies and guidelines. Primary sources of unrestricted revenues:

-

State Appropriation - revenues legislated to the college by the General Assembly.

-

Under current RI law, the Council on Postsecondary Education cannot transfer these funds between institutions.

-

-

Tuition and Fees - revenues generated by the institution through student enrollment.

-

Student tuition and fee rates must be approved by the Council on Postsecondary Education. The General Assembly does not have the authority to set these rates or to change recommendations approved by the Council on Postsecondary Education. The level and distribution of student enrollment and the distribution of students between full time and part-time strongly affect this revenue stream and therefore the discretionary spending of the college.

-

-

Indirect Cost Recovery - revenues resulting from federal student aid & grants

-

These are revenues that derived from federal student aid options such as Pell grants and college work study funds. Federal, state and private grants are also charged a indirect cost rate, varying by type of grant and funding source. The revenues produced are intended to offset administrative costs not directly attributable to the grant project. The Bookstore is also charged an auxiliary indirect cost rate.

-

-

Sales & Service of Educational Activities - primarily the result of fee-based programs housed in the Center for Workforce and Community Education division.

-

These programs are designed to be self sufficient as well as contribute positively to the college's overall budget and mission. Includes state programs such as those mandated by the DMV like the Motorcycle Training, Commercial Driving and Driver's Education as well as various court mandated programs. Workforce Training programs such as CNA, Pharmacy and Vet Training etc. also contribute to this funding.

-

-

Other Income - all other unrestricted revenue streams to the college

-

Includes investment income, facility rental, and other miscellaneous revenues.

-

RESTRICTED REVENUES - These are funds that are designated to the institution by a third party for a specific purpose and those funds can only be used for that purpose. This includes federal, state and private grants, federal grants and scholarships, Driver's Education and monies allocated for capital improvement through the RI Capital Asset Protection (RICAP) program.

-

The College's Foundation and Alumni are also restricted funds but exist in a separate tax entity outside of the college's direct purview.

-

Student Clubs, Student Government and Athletics are a hybrid of unrestricted and restricted monies. There is a distribution of Student Activity fees that is from an unrestricted source of student fees. This is apportioned between Clubs and Government and Athletics annually. Many of these entities also conduct fund raising activities which are restricted in their expenditure intent to specific programs.

-

Auxiliary Services - Council on Postsecondary Education policy classifies student support activities such as the Bookstore and Dining as Auxiliary Enterprises. The Bookstore is a self-supporting entity that generates profits that are earmarked specifically for auxiliary improvement and operations. Dining at CCRI is currently a commissioned contract that generates nominal profit but serves all four campuses.

FTE Resources

-

The General Assembly legislates the number of Full Time Equivalent (FTE) positions that the college can have on the permanent, biweekly payroll in any given period. The breakdown is as follows:

-

Unrestricted (including Bookstore) 765.10

-

3rd Party (grant, fee based programs) 89.00

-

Total: 854.10

-

-

There is also legislation that does not permit the college to eliminate classified employees (Merit law based) with non-classified or faculty slots (Board based).

-

Since the college has more FTE's in its Table of Organization than the college has approved state FTE's, these competing needs must be strategically balanced just like any other budget resource.

Contact Information

Knight Campus

2nd Floor

400 East Ave.

Warwick, RI 02886

Tel: (401) 825-2184

Fax: (401) 825-2365

Annmarie McMahon

Director, Budget and Financial Planning

Tel: 401-825-2184

Kent Gates

Budget Specialist, Website Content Manager

Tel: 401-825-1114