Understanding your 1098-T

Education tax credits may be available to you if you are paying educational costs for yourself or a student who is an immediate member of your family.

The Community College of Rhode Island is required by federal law to provide a completed IRS 1098-T form to all students enrolled in courses for "credit" for which a reportable transaction is made for any given calendar year. A reportable transaction is defined as tuition and certain fees a student must pay to enroll at the college. This student enrollment and financial data is then transmitted to the IRS.

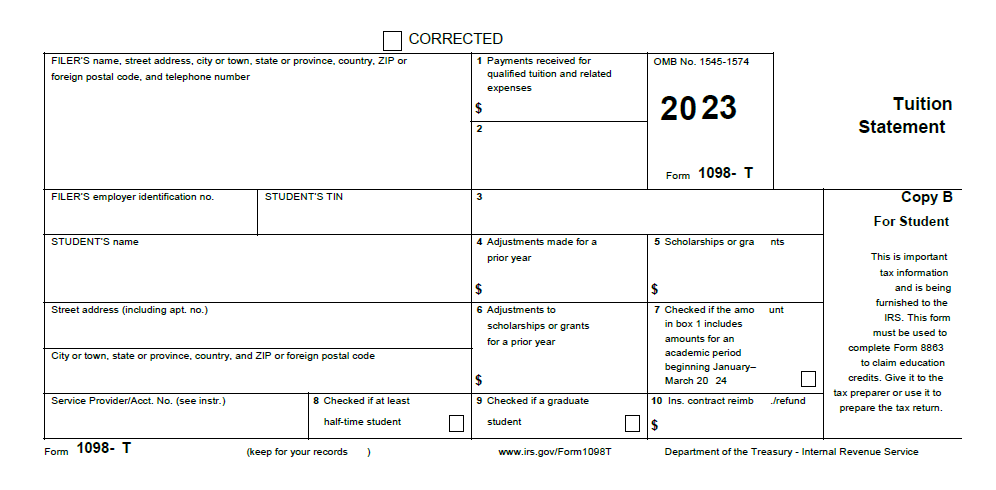

For the IRS Form 1098-T, the Community College of Rhode Island reports:

Box 1 - payments received for qualified tuition and related expenses

Box 4 - adjustments made for a prior year

Box 5 - the total amount of scholarships and or grants

Box 6 - adjustments to scholarships or grants for a prior year

Note: The reporting of tuition, fees, scholarships, grants, and adjustments do not determine the tax credit or taxability of these amounts being reported; it is the students' responsibility, not the college's to determine the taxability of scholarships and grants or the tax credits available. Please consult your tax advisor.

The Community College of Rhode Island will mail student's IRS Form 1098-T prior to February 1st for the prior calendar year's financial account activity as required by federal law.

Click Here for directions on how to Print an Official copy of your Tax Form 1098-T.

In order to provide you with IRS Form 1098-T and to report your student financial data to the IRS the college must have:

- Your valid Social Security Number (SSN) on file.

- Your valid address to ensure timely and accurate reporting of your Form 1098-T each year. Please keep your address up to date by contacting the Office of Enrollment Services.

For complete information regarding Education Tax Credits see the most current versions of IRS Publication 970, Tax Benefits for Education, IRS Form 8863, Education Credits, or consult your tax advisor.